Do You Feel In The Red?

You are presumably not the only one. As per a report by the New York Federal Reserve, family obligations developed by $192 billion in the second quarter of 2019. Truth be told, the family obligation level came to $13.86 trillion – another record for a family obligation, outperforming the old record set. Around the hour of the 2008 monetary emergency.

Click on this whatisss.com

Non-private totals expanded by $37 billion, of which $20 billion came from expansions in charge card adjusts. This diagram from the New York Fed shows how obligation has been filling as of late.

You should know all about how to add music to imovie

Non-Private Advance Equilibrium

To severely thrash obligation, there is trust. There are a few techniques for managing your obligation and escaping the opening rapidly. The following are 12 hints that can assist you with escaping obligation quicker.

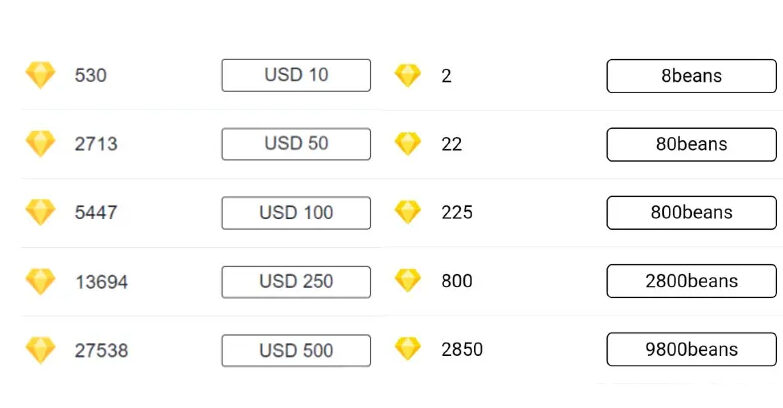

1. Begin paying more than the base

In the event that you’re just paying the base equilibrium on your charge card, you could be dialing back your advancement. Take the model beneath:

Installment data

Installment Due Date (For the web and telephone installments, the cutoff time is 8 PM ET.): November 18, 2019

New Balance: $1251.20

Least Payment Due: $25.00

Late Payment Warning: If we don’t accept your base installment by your due date, you might cause a late charge of up to $39.00.

Least Payment Warning: If you make just the base installment every period, you’ll pay more interest and take more time to take care of your equilibrium. For instance:

Assuming you bring about no extra charges utilizing this card and pay consistently you:

You will pay the equilibrium displayed in this articulation as follows:

Furthermore, you need to pay the complete assessment:

least installment

10 years

$3,105

$51

3 years

$1,826

Assessed investment funds in the event that equilibrium is taken care of more than roughly 3 years: $1,239

While making just the base installment, you’ll take care of the credit for a long time – – and that is not even liable for making new buys. In this model, paying somewhat more than twofold the base installment would take care of the credit in three years, saving $1,279 in interest.

Investigate your financial record and check whether you can decrease the time you stray into the red by paying more than the base.

2. SURVEY (AND IMPROVE) YOUR FINANCIAL PLAN

Is it true or not that you are squandering cash? You might have a decent opportunity. Laying out a spending plan can assist you with taking care of obligations rapidly. Track your spending for half a month and afterward investigate what is going on. Distinguish the things you are squandering cash on and cut them out of your spending. Then, at that point, take the reserve funds and apply them to take care of your obligation. You may be amazed by the way that rapidly your advanced equilibrium vanishes.

3. Make A Debt Repayment Plan

Snowball Loan Payment Plan

When you understand what you want to pay more than the base and you distinguish the loss in your financial plan, you can make an obligation installment plan. A decent arrangement can keep you on target while giving you objectives to go for the gold.

Two of the most famous ways of escaping obligation quickly are the obligation snowball and the obligation torrential slide. Both of these methodologies recommend that you tackle each advance in turn with all of your overabundance cash while making the least installments on the other equilibrium.

The thing that matters is the request you use to address the obligation. With the snowball strategy, you start with the littlest equilibrium, which gives a mental lift and a speedy success. The obligation torrential slide, then again, recommends beginning with the most noteworthy interest balance. It might take more time to acquire that first success to resign the equilibrium, yet over the long haul, you’re probably going to take care of obligation quicker and save more in interest with the torrential slide.

Regardless of which approach you take, the significant thing is to plan and remain focused. In the event that you need assistance dealing with your arrangement, a help like Tally can help you.

4. Consider 0% Apr Balance Transfer

To dial back the collection of interest on a portion of your obligation, moving the 0% APR equilibrium to another Visa can help. With this methodology, you get the best proposal with a long beginning period. Move however much of your exorbitant interest balance as could be expected to a 0% card and manage different obligations.

Moving exorbitant premium adjusts to a 0% APR card will assist you with abstaining from building interest while holding the equilibrium under tight restraints. When you shift to paying the 0% equilibrium, each penny goes towards a decrease in the head. Simply ensure you can finish the move before the finish of the 0% APR initial period. In the event that you don’t pay the absolute equilibrium sum, the expressed loan cost will be charged on the equilibrium. Likewise, figure out what the APR is for new buys. On the off chance that it’s not 0%, don’t add more obligation to the equilibrium move card. Utilize the new card just to take care of your current obligation.

5. Request A Lower Interest Rate

Have you been a decent client, paying on time? with your charge card guarantor